" data-"http://www.elite6.co.nz/wp-content/uploads/2016/10/Brian-Magellan-SwainWoodhamGroup-2-50x50.jpg 50w, http://www.elite6.co.nz/wp-content/uploads/2016/10/Brian-Magellan-SwainWoodhamGroup-2-66x66.jpg 66w, http://www.elite6.co.nz/wp-content/uploads/2016/10/Brian-Magellan-SwainWoodhamGroup-2-200x200.jpg 200w, http://www.elite6.co.nz/wp-content/uploads/2016/10/Brian-Magellan-SwainWoodhamGroup-2-230x230.jpg 230w, http://www.elite6.co.nz/wp-content/uploads/2016/10/Brian-Magellan-SwainWoodhamGroup-2.jpg 240w" data-sizes="auto" data-orig-sizes="(max-width: 240px) 100vw, 240px" /> How to Optimize and Structure your Personal and Business Insurances and Mortgage for maximum success and happiness

Most people know exactly how much they pay for their personal and business insurance products, but don’t know what value they actually receive from their particular provider’s insurances.

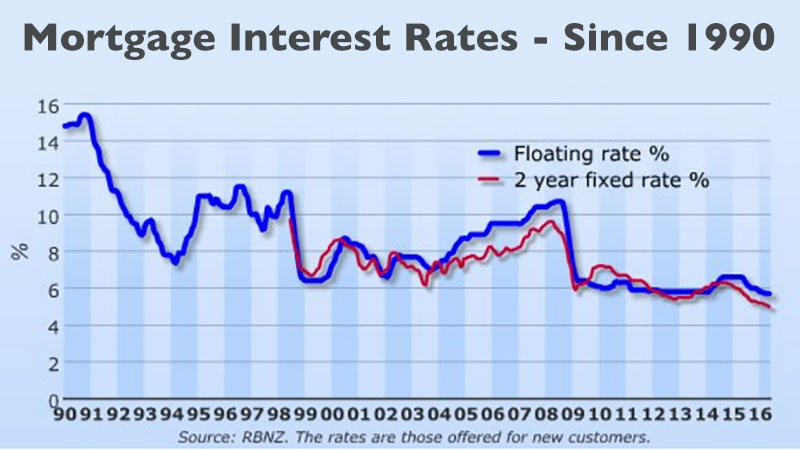

On the other hand, whilst most people have a very good idea of the value they receive from their mortgage i.e. the value of their home and investment properties, they often don’t know the price i.e. the interest rate that they are actually paying.

In both scenarios, individuals and small business owners are often unaware that better value personal and business insurances exist, and more cost-effective mortgages are available to them. And most unfortunately, having inappropriate or incorrectly structured insurances and mortgages in place can leave them, their families, and business exposed to financial hardship and ruin.

-

The real cost of inferior insurance products

The real cost of inferior insurance products can be shocking – a stuff newspaper article talked about an Australian man whose insurer declined his claim for a heart attack because it did not meet their strict guidelines.

What is most concerning is that:

New Zealand insurance expert Russell Hutchinson from Quality Product Research, studied which New Zealand policies would have made full, partial or no payout in the Australian man’s case. He found Partners Life and eight other policies would be likely to have made a full payout. ASB, Sovereign and Onepath (owned by ANZ) would be likely to have made a partial payout, and policies including Westpac’s would be likely to have made no payout at all.

The value of insurance is that you are paid at claim time when you suffer an illness or injury – but many people only focus on the cost of insurance, which can leave them, their families, and business unprotected. Don’t let this happen to you.

-

The real cost of not utilizing the correct mortgage strategy to support your insurance strategy

Leave A Comment

You must be logged in to post a comment.